Amortization schedule with fixed monthly payment and balloon

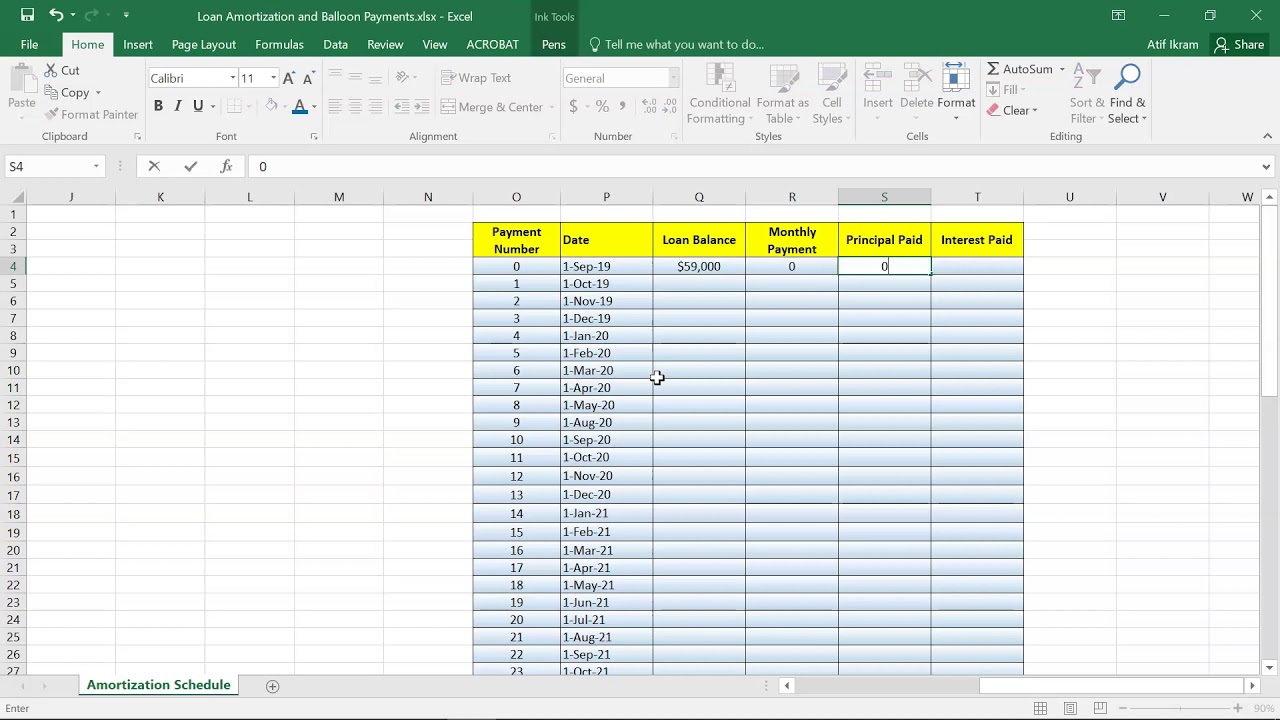

Click on the fifth row. Now you can create the amortization schedule.

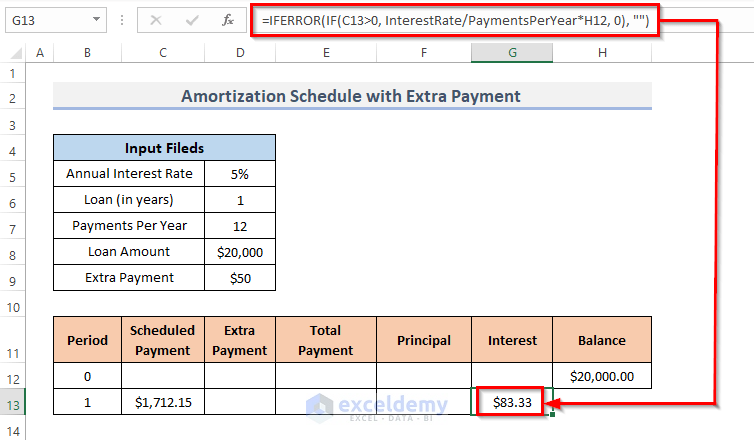

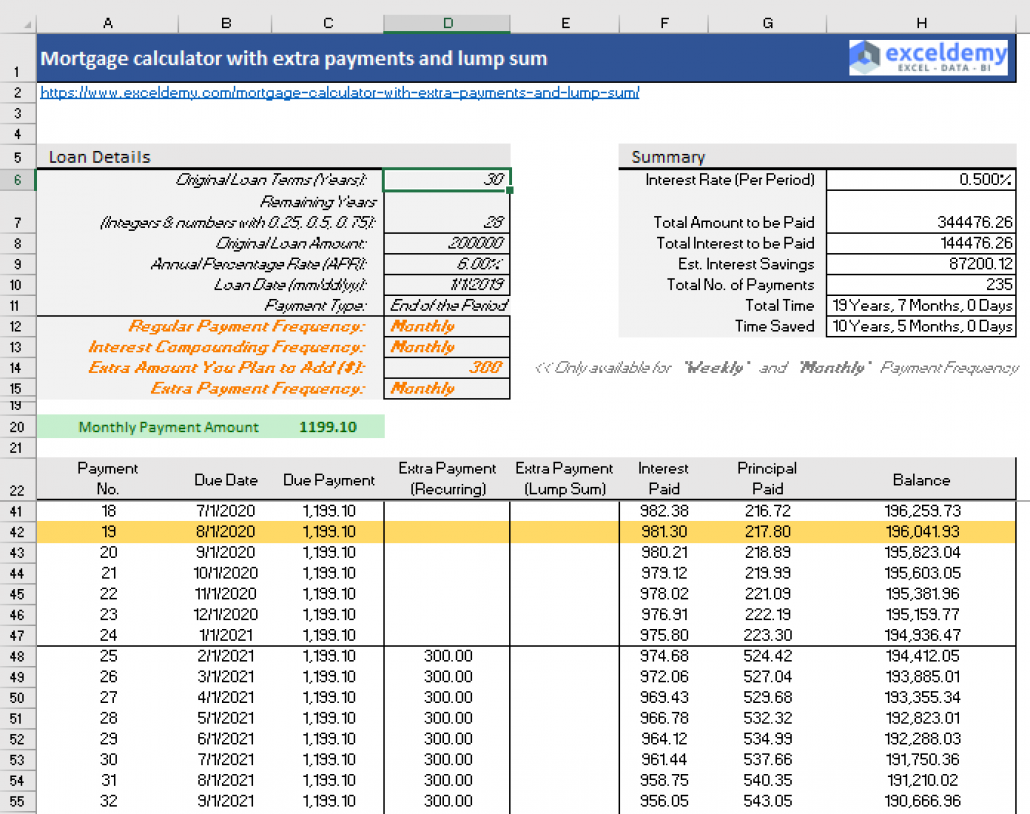

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

After making 4 regular payments as well as one early payment with an extra 10000 missing a payment and making a payment that is short by 5000 your cash flow data screen will look like this.

. We will quickly return your payment amount total interest expense total amount repaid the equivalent interest-only payments to show how much you would end up spending on interest if you did not pay down the balance. Principal Payment Monthly payment Interest payment 26337. Compare Home Financing Options Online Get Quotes.

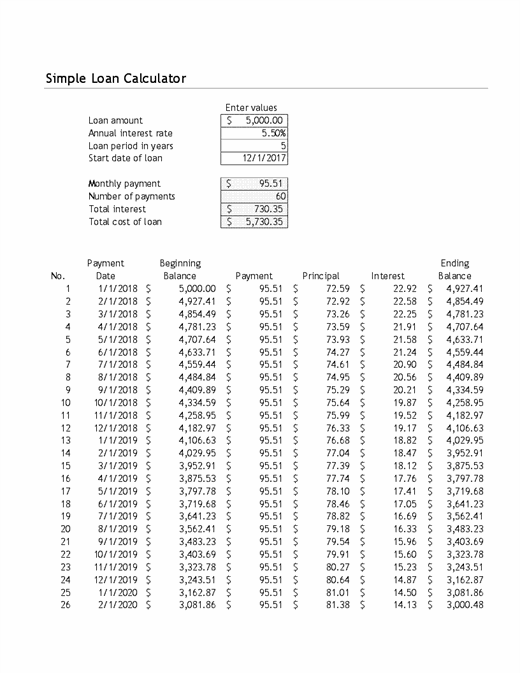

Amortization Schedule is an amortization calculator used to calculate mortgage or loan payments and generates a printable amortization schedule with fixed monthly payment. An amortization schedule is a table detailing each periodic payment on an amortizing loan typically a mortgage as generated by an amortization calculator. Get Instantly Matched with the Best Personal Loan Option for You.

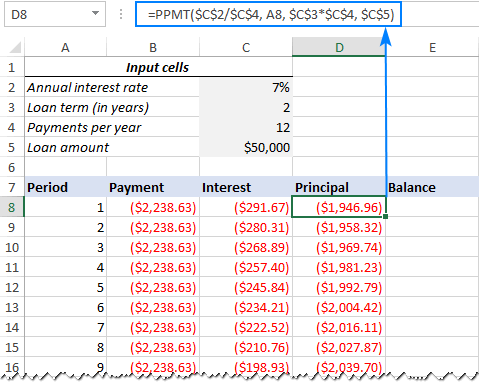

That is unlike a typical loan which has a level periodic payment amount the principal portion of the payment is the same payment to payment and the interest portion of the payment is less each period due to the declining principal balance. Subtract your interest payment from your total monthly payment to see how much goes toward paying down your loan. Add APR Truth-In-Lending disclosures.

Vertex42 provides high quality free Excel-based loan calculators to both individuals and industry professionals. A fixed principal payment loan has a declining payment amount. How Much Will My Monthly Mortgage Payments Be.

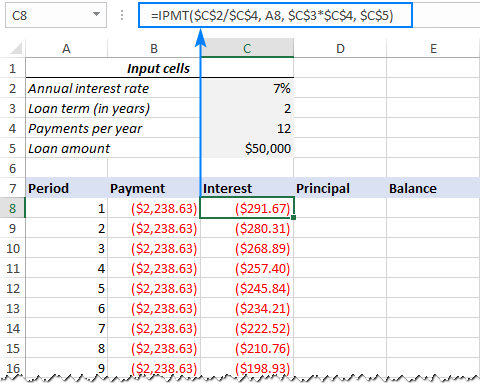

Loans with bullet repayments are also referred to as balloon loans and are commonly. Other common domestic loan periods include 10 15 20 years. Divide your interest rate by 12 to get your monthly interest rateIn this case its 0008333 01012.

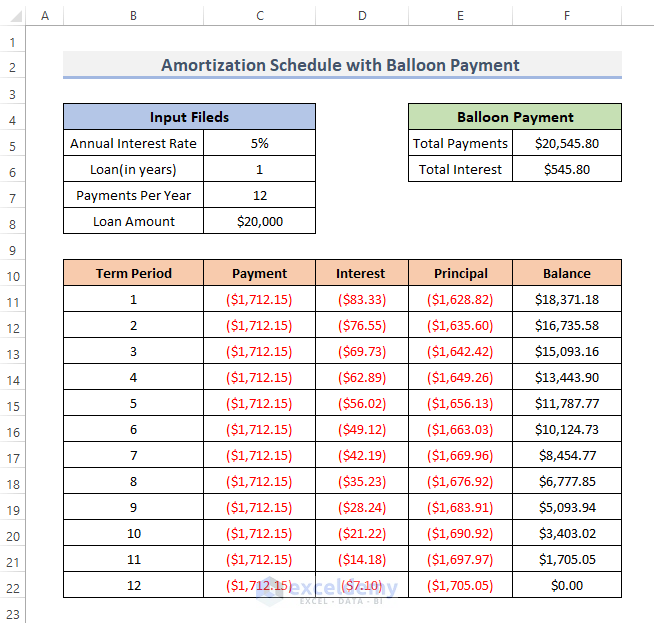

Its used commonly for mortgages auto loans student loans and personal loans. For instance a mortgage amortization schedule with a balloon payment will look different from a personal loan with a shorter term length and no balloon. Fixed principal payment calculator help.

In this example its 31833 35166 3333. It includes advanced features like amortization tables and the ability to calculate a loan including property taxes homeowners insurance property mortgage insurance. Repeat this calculation for all 60 payments of the 5-year balloon loan.

Amortization refers to the process of paying off a debt often from a loan or mortgage over time through regular payments. How to Calculate Mortgage Payments in Excel With Home Loan Amortization Schedule Extra Payments. Ad 7 Best Personal Loan Company Reviews of 2022.

Example of Amortization Schedule. Here are the types that you need to know. Amortized Paid Date is a repayment plan that consists of both principal and interest.

View totals at selected intervals by calendar or fiscal year-end. Ad Need To Know How Much You Can Afford. Export amortization schedules to Microsoft Excel and Word and to PDF CSV and XML with one-click.

Ad Leading Software for Amortization. Loan term in years - most fixed-rate home loans across the United States are scheduled to amortize over 30 years. This tool allows you to calculate your monthly home loan payments using various loan terms interest rates and loan amounts.

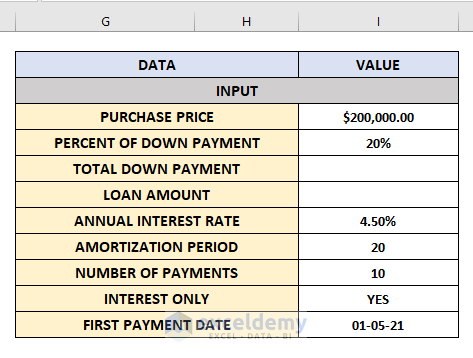

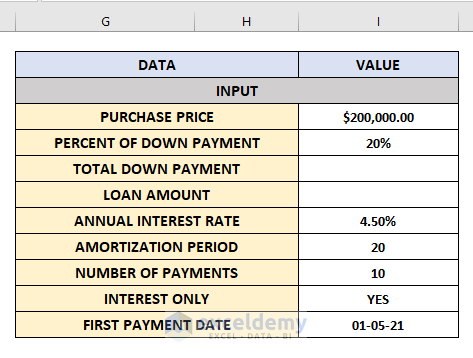

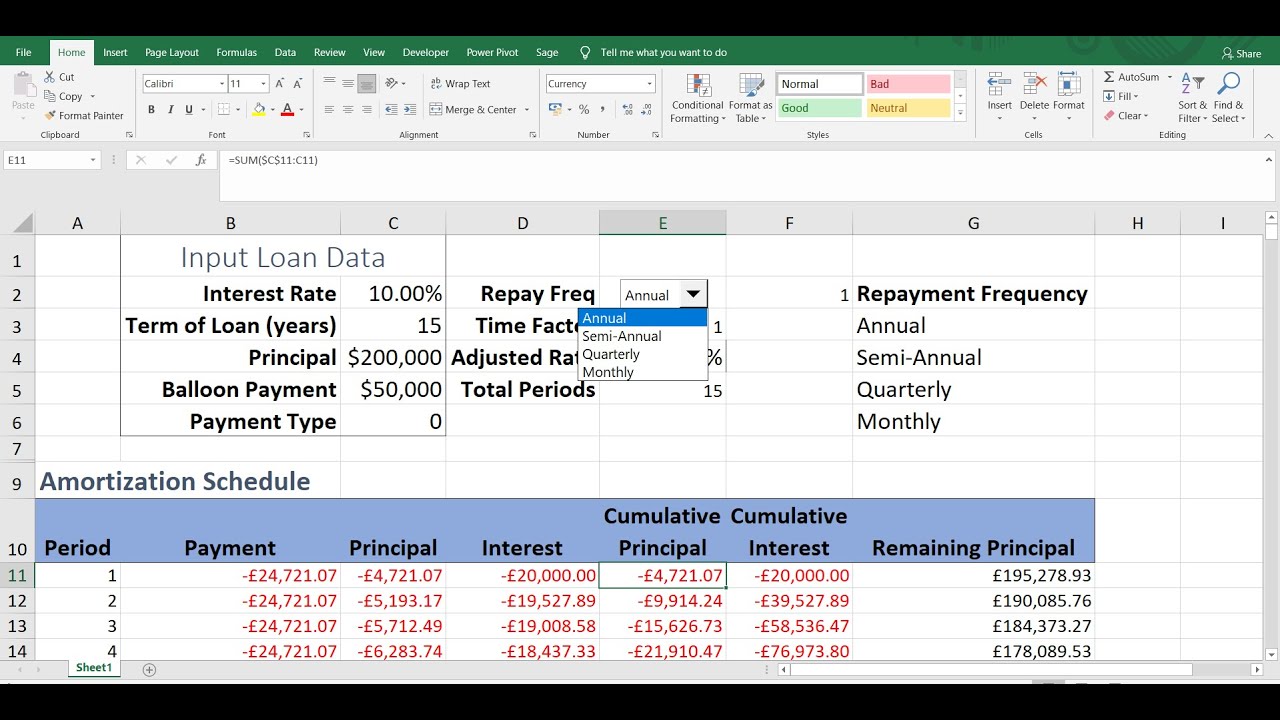

Select any level of detail from summary to full schedule. With Interest Only loans the monthly payments do not. The type of amortization schedule on excel depends on how frequently interest is compounded on the loan ie.

It only works for fixed-rate loans and mortgages but it is very clean professional and accurate. Calculate your principal payment. A bullet repayment is a lump sum payment for the entirety of a loan amount paid at maturity.

These are often 15- or 30-year fixed-rate mortgages which have a fixed amortization schedule but there are also adjustable-rate mortgages ARMs. Easily Calculate Loans APRs and More. Most people dont keep the same home loan for 15 or 30 years.

You can use this online amortization schedule calculator to calculate monthly payments for any type of loans such as student loans personal loans car loans or home. A portion of each payment is for interest while the remaining amount is applied towards the. Print a limited date range.

Calculate your interest payment. The following table shows the amortization schedule for the first and last six months. Skip the Bank Save.

Find your monthly interest rate. Types of Amortization Schedule. Amortized Due Date is amortized and interest is collected through the due date.

Consider a 30000 fully amortizing loan with a term of five years and a fixed interest rate of 6. Payments are made on a monthly basis. We believe that a strong basic financial education is the key to living within your means avoiding bad debt and becoming financially secure.

Insert optional headers and footers. Comparisons Trusted Low Interest Rates. This spreadsheet lets you choose from a variety of payment frequencies including Annual Quarterly Semi-annual Bi-Monthly Monthly Bi-Weekly or Weekly Payments.

Interest Only Loan is a payment plan that covers only the interest amount of the principal. With ARMs the lender can adjust the rate on a predetermined schedule which would impact your amortization schedule. Depending on the type you can make payments accordingly on the basis of the compounding interest.

The loan is fully amortized with a fixed total payment of 57998 every month. Set series to Payment Set the date to September 16 Set the Amount to 18091 Set the Periods to 1. Current Loan Balance Starting loan balance Principal payment.

The most capable and trusted financial calculation solution since 1984. Well Help You Estimate Your Monthly Payment. Payments are usually divided into equal amounts for the length of the loan.

Monthly weekly or daily. Simply enter the amount borrowed the loan term the stated APR how frequently you make payments. In lending amortization is the distribution of loan repayments into multiple cash flow instalments as determined by an amortization scheduleUnlike other repayment models each repayment installment consists of both principal and interest and sometimes fees if they are not paid at origination or closingAmortization is chiefly used in loan repayments a.

Optional extra payment - if you want to add an extra amount to. Amortization involves breaking a fixed-rate loan into equal monthly payments to pay off by a certain date.

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Amortization Schedule With Balloon Payment And Extra Payments In Excel

Amortization Schedule With Balloon Payment Using Excel To Get Your Finances On Track Udemy Blog

Loan Amortization And Balloon Payments Using Ms Excel Youtube

Customizable Amortization Schedule Excel Template Bpi The Destination For Everything Process Related

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

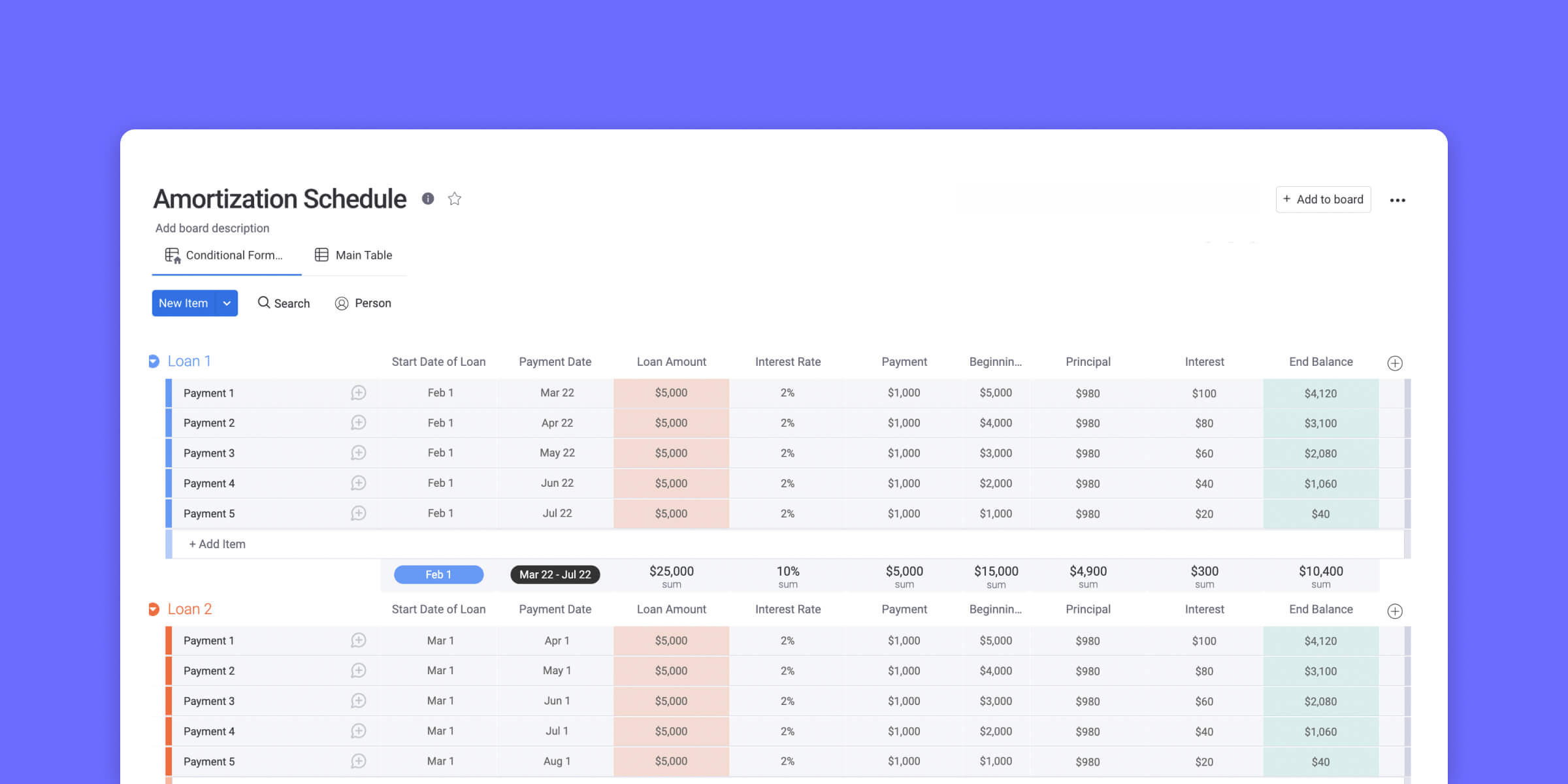

Easy To Use Amortization Schedule Excel Template Monday Com Blog

Excel Interest Only Amortization Schedule With Balloon Payment Calculator

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Easy To Use Amortization Schedule Excel Template Monday Com Blog

Time Value Of Money Board Of Equalization

Loan Amortization Schedule With Variable Interest Rate In Excel

Balloon Loan Calculator Single Or Multiple Extra Payments

Amortization Schedule With Balloon Payment Using Excel To Get Your Finances On Track Udemy Blog

Amortization Schedule With Balloon Payment And Extra Payments In Excel

Excel Interactive Loan Amortisation Table Change Repayment Frequency Include Balloon Payment Etc Youtube