Accumulated amortization formula

Relevance and Uses of MTBF Formula. Cr_Accumulated depreciation 40000 BS Total accumulated depreciation expenses at the end of 31 December 2019 is USD440000.

How To Calculate Amortization For Intangible Assets Universal Cpa Review

Luxurious Company reported the cost of.

. Finally MTBF can be calculated using the above formula. Accumulated Depreciation on Machinery Rs. It is also easily available in the income statement.

As the name suggests these costs are variable in nature and changes with the increase or. It will depend on various factors like the products utility uniqueness. So the formula of total assets and calculation can be done as follows.

This is expected to have 5 useful life years. Here we discuss how to calculate Capital Expenditure along with step-by-step examples. Firstly determine the minimum at which the producer is willing or able to sell the subject good.

An assets carrying value on the balance sheet is the difference between its purchase price. Consider the following examples to better understand the calculation of amortization through the formula shown in the previous section. Net increase in PPE in 2017 33783 27010.

What is the Coefficient of Determination Formula. The balance sheet of a firm records the monetary. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

For a one-year period following formula can be used. Firstly figure out the listed price of the product. MTBF TOT F.

In other words Amortization refers to the systematic allocation of the cost of the Intangible Asset as an expense over its useful life. It reflects the utilization of the intangible asset over its useful life. Next determine the depreciation amortization expense on the tangible and intangible assets respectively.

Net working capital 7793 Cr Based on the above calculation the Net working capital of Colgate Palmolive India is positive which indicates that the short-term liquidity position of the company is positive. As such it can also help an accountant to track how much useful life is remaining. Now determine the discount rate offered on the product as part of the sales promotion initiatives.

Depreciation and amortization closing 49099. Accumulated depreciation on 31 December 2019 is equal to the opening balance amount of USD400000 plus depreciation charge during the year amount USD40000. Amortization is the paying off of debt with a fixed repayment schedule in regular installments over a period of time for example with a mortgage or a car loan.

Failure Rate is just the reciprocal value of MTBF. On April 1 2012 company X purchased a piece of equipment for Rs. Firstly determine all the costs incurred for operating and managing the investment fund and that primarily includes audit cost transactional cost legal fees fund manager fees transfer fees marketing fees along with other miscellaneous expenses.

Accumulated depreciation is the total depreciation of the fixed asset accumulated up to a specified time. MTBF value simply tells about a products survival time. A portion of each payment is for interest while the remaining amount is applied towards the.

An amortization schedule is a table detailing each periodic payment on an amortizing loan typically a mortgage as generated by an amortization calculator. It is anything tangible or intangible that can be used to produce positive economic valueAssets represent value of ownership that can be converted into cash although cash itself is also considered an asset. Amount paid monthly is known as EMI which is equated monthly installment.

The formula for Expense Ratio can be calculated by using the following steps. Amortization Formula Table of Contents Amortization Formula. In financial accounting an asset is any resource owned or controlled by a business or an economic entity.

Examples of Inventory Turnover Ratio Formula Luxurious Company sells industrial furniture for the office buildings Infrastructure During the current year. Amortization refers to the process of paying off a debt often from a loan or mortgage over time through regular payments. Thus Amortization is much like Depreciation.

Firstly determine the variable cost of production per unit which can be the aggregate of various cost of production such as labor cost raw material cost commissions etc. R 75 per year 12 months. Net Working Capital Total Current Assets Total Current Liabilities.

Now let discuss how to calculate accumulated depreciation. The formula for fixed cost can be calculated by using the following steps. It is calculated for intangible assets as the actual cost less amortization expenseimpairments.

Guide to Capital Expenditure Formula. The above formula is the underlying principle for various productivity metrics such as revenue per employee revenue per hour units produced per hour etc. Net working capital 106072 98279.

Coefficient of Determination Formula Table of Contents Formula. Amortization refers to paying off debt amount on periodically over time till loan principle reduces to zero. It has a useful life of 10 years and a salvage value of 100000 at the end of its useful life.

Next determine the actual selling price of the product at which it is being traded in the market place. Examples of Productivity Formula With Excel Template Lets take an example to understand the calculation of Productivity in a. Amortization Formula in Excel With Excel Template Amortization Formula.

So here P 20000. It also refers to the spreading out. The cost of the fixed asset is 5000.

Fixed Cost Explanation. Get 247 customer support help when you place a homework help service order with us. Furniture was purchased on the last day of the financial year.

In other words if we have dependent variable y and independent variable x in. Amortization calculation for a Vehicle Car. Amortization is nothing but a charge against an intangible asset.

It is very important in Hardware product Industries rather than consumers. Finally the formula for EBITDA can be derived by adding interest step 2 tax step 3 and depreciation amortization step 4 to the net income step 1 as shown below. Accumulated depreciation is the cumulative depreciation of an asset up to a single point in its life.

Thus the formula is FR 1 MTBF. Discount Listed Price Discount Rate. The rate of depreciation is 50 and the salvage value is 1000.

Accumulated Depreciation Formula Example 1. The expense would go on the income statement and the accumulated amortization will show up on the balance sheet. In statistics coefficient of determination also termed as R 2 is a tool which determines and assesses the ability of a statistical model to explain and predict future outcomes.

Finally the formula for discount can be derived by multiplying the offered discount rate step 2 and the listed price step 1 of the product as shown below. The first formula for producer surplus can be derived by using the following steps. Accumulated Depreciation on Vehicles Rs.

Accumulated depreciation formula after 3 rd year Acc depreciation at the start of year 3 Depreciation during year 3 40000 20000 60000. For example suppose company B buys a fixed asset that has a useful life of three years. Company X considers depreciation expenses for the nearest whole month.

Company ABC bought machinery worth 1000000 which is a fixed asset for the business. The salvage value is Rs. Accumulated Depreciation on Buildings Rs.

Depreciation Depletion And Amortization Double Entry Bookkeeping

How To Calculate Amortization For Intangible Assets Universal Cpa Review

Amortization Of Intangible Assets Formula And Calculator Excel Template

Epqbmgzg3vilm

Accumulated Depreciation Definition Formula Calculation

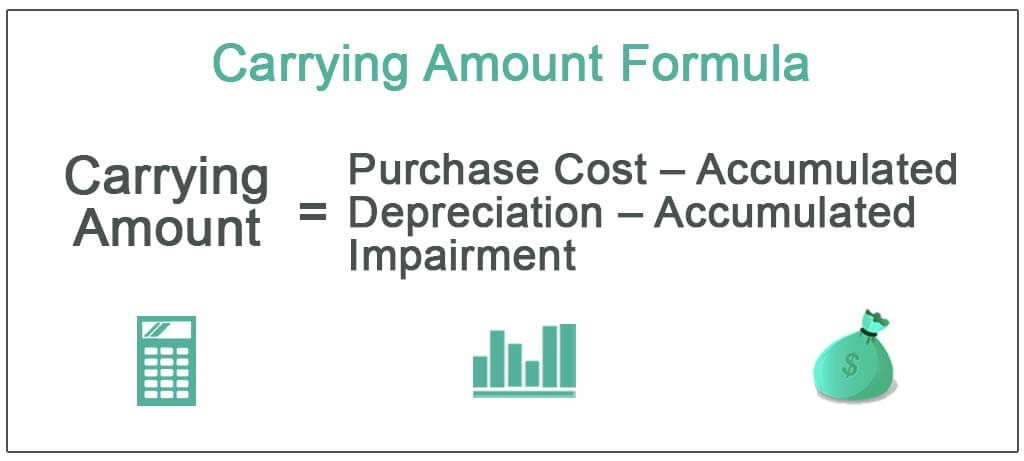

Carrying Amount Definition Formula How To Calculate

Loan Amortization Schedule Calculator Home Mortgage Calculator College Loan Calculator Car Loan Calculator Pay Off Mortgage Pay Off Loan

Depreciation Formula Examples With Excel Template

Accumulated Depreciation Definition Formula Calculation

Amortization Of Intangible Assets Formula And Calculator Excel Template

Accumulated Depreciation Definition Formula Calculation

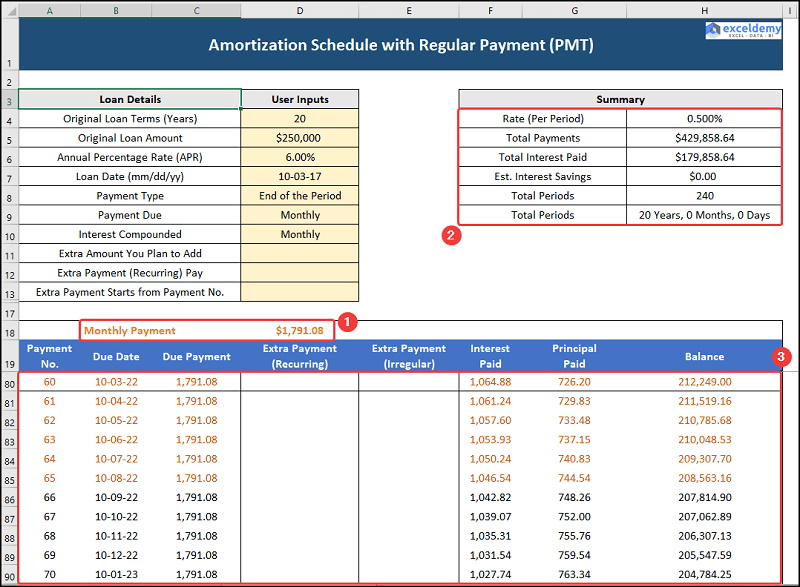

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

What Is Accumulated Depreciation How It Works And Why You Need It

How To Calculate Amortization For Intangible Assets Universal Cpa Review

Accumulated Depreciation Overview How It Works Example

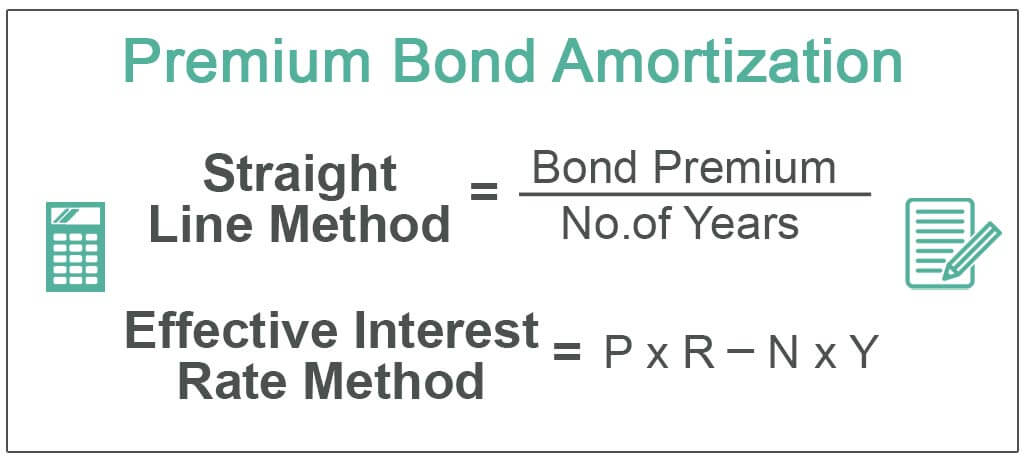

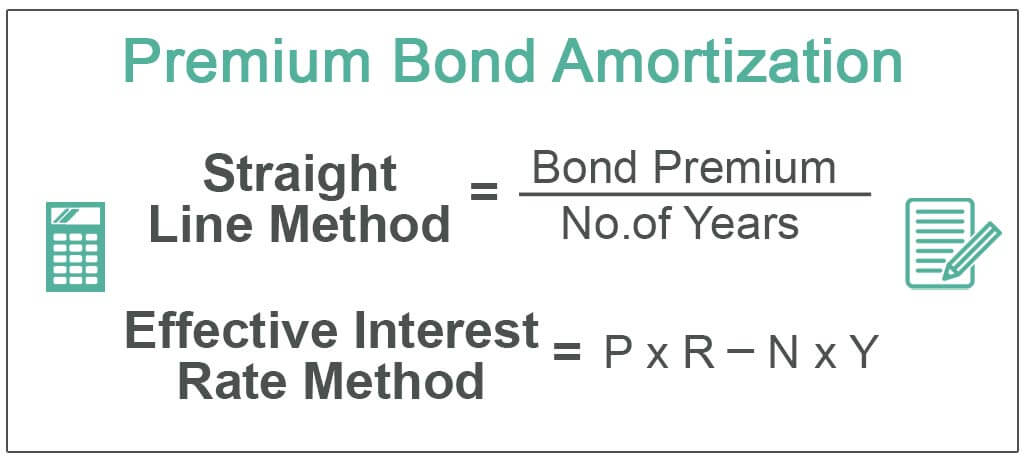

Amortization Of Bond Premium Step By Step Calculation With Examples

Depreciation Formula Examples With Excel Template